Finance & Business

Ford Pivots Strategy: Why the Automotive Giant Is Pumping the Brakes on EVs

The electric vehicle revolution may be hitting a speed bump. Ford Motor Company, one of America's most iconic automakers, recently announced significant changes to its electric vehicle strategy, sending shockwaves through the automotive industry and raising important questions about the future of EV adoption in the United States.

Ford's EV Strategy Shift: What's Actually Happening

Ford has decided to delay several key electric vehicle launches and reduce planned EV production capacity while simultaneously ramping up investment in hybrid technology. This strategic pivot represents a major recalibration from the company's earlier aggressive electrification timeline, which had promised to transform Ford into an EV powerhouse by the mid-2020s.

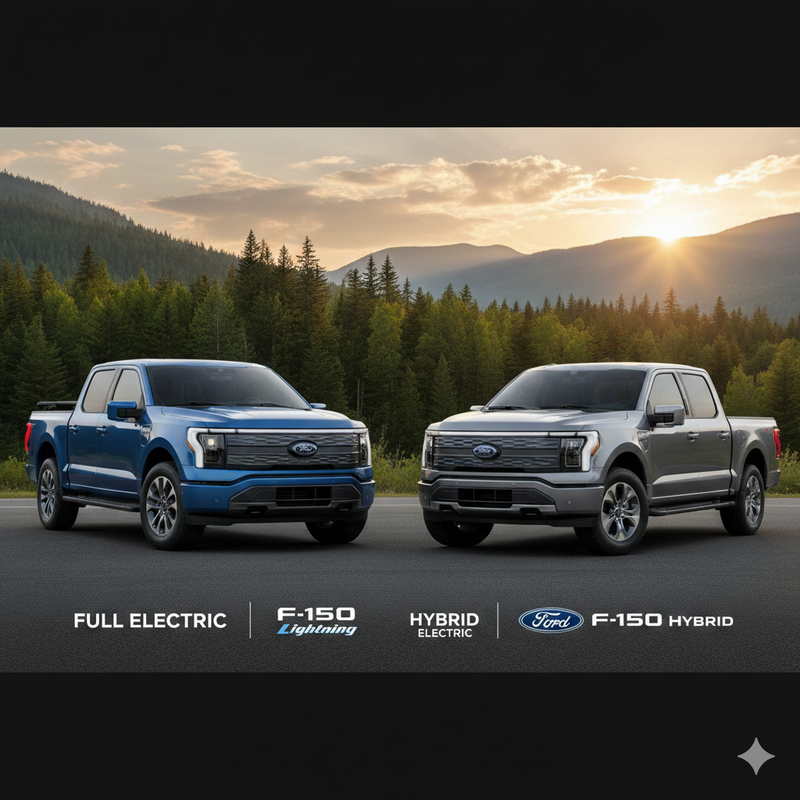

The shift affects multiple vehicle segments. Ford is extending development timelines for upcoming electric SUVs and delaying the launch of next-generation battery technology that was supposed to reduce costs and improve range. Meanwhile, the company is maintaining production of popular models like the F-150 Lightning and Mustang Mach-E, but at more conservative volumes than initially projected.

This isn't abandonment—it's recalibration. Ford executives emphasize that electrification remains central to the company's long-term vision, but the path forward will be more measured, responding to actual market demand rather than anticipated future trends.

Why Is Ford Pumping the Brakes on Electric Vehicles?

Several interconnected factors are driving Ford's strategic adjustment, and understanding these dynamics is crucial for anyone following automotive trends or considering an EV purchase.

Consumer Demand Reality Check

Despite impressive EV sales growth, consumer adoption hasn't matched industry projections. Range anxiety remains a significant concern for potential buyers, especially those in rural areas or regions with limited charging infrastructure. The average American driver still hesitates to commit to fully electric transportation, preferring the flexibility and familiarity of traditional or hybrid powertrains.

Recent surveys indicate that while consumers express interest in EVs for environmental reasons, practical concerns about charging time, upfront costs, and resale value continue to slow adoption rates. Ford's market research likely revealed that pushing aggressive EV production could result in unsold inventory and financial losses.

Economic Pressures and Profitability Challenges

Electric vehicles remain expensive to manufacture. Battery costs, specialized components, and new production facilities require massive capital investment with uncertain return timelines. Ford's EV division has reportedly operated at substantial losses, with the company investing billions while struggling to achieve economies of scale.

The competitive landscape has intensified as well. Tesla maintains dominant market share, while Chinese manufacturers like BYD produce EVs at lower costs. Traditional competitors including General Motors, Toyota, and Volkswagen are all vying for position in an increasingly crowded marketplace, compressing profit margins across the industry.

Supply Chain and Infrastructure Constraints

The global supply chain for EV components remains fragile. Lithium, cobalt, and other critical battery materials face sourcing challenges and price volatility. Semiconductor shortages, while improving, continue affecting production schedules. These constraints make scaling EV production riskier and more expensive than initially anticipated.

Additionally, America's charging infrastructure hasn't kept pace with EV growth. While networks are expanding, the uneven distribution of charging stations creates practical barriers for many potential buyers, particularly those without home charging capabilities.

The Hybrid Advantage: Ford's Middle Path

Rather than full retreat, Ford is emphasizing hybrid technology as a transitional solution. Hybrids offer compelling advantages: improved fuel efficiency, lower emissions than traditional vehicles, and none of the range anxiety associated with pure EVs. For many consumers, hybrids represent the sweet spot between environmental consciousness and practical convenience.

Ford's bestselling F-150 lineup exemplifies this strategy. While the all-electric Lightning appeals to early adopters, hybrid F-150 variants attract traditional truck buyers seeking better fuel economy without sacrificing capability. This diversified approach lets Ford serve multiple customer segments while hedging against market uncertainty.

The company is also investing in plug-in hybrid technology, which combines electric driving for daily commutes with gasoline backup for longer trips. This flexibility addresses one of the primary objections potential EV buyers raise—the fear of being stranded with a depleted battery.

What This Means for Car Buyers in 2025 and Beyond

Ford's strategic shift carries important implications for consumers navigating vehicle purchase decisions. If you're considering buying a Ford—or any vehicle—in the near future, here's what you need to know.

First, internal combustion engines aren't disappearing anytime soon. Ford's recalibration suggests that traditional and hybrid powertrains will remain viable options for years, potentially decades. This should reassure buyers worried about being forced into EVs before they're ready.

Second, EV technology will continue improving. Ford's more measured approach may actually benefit consumers, allowing the company to refine battery technology, reduce costs, and improve reliability before mass-market launches. Patience could result in better products with fewer first-generation issues.

Third, hybrid vehicles represent an increasingly attractive option. With Ford expanding hybrid availability across its lineup, buyers can achieve significant environmental benefits and fuel savings without the infrastructure concerns of pure EVs.

Industry-Wide Implications and Competitor Responses

Ford isn't alone in reassessing EV timelines. Other major automakers are quietly adjusting expectations, extending development schedules, and emphasizing flexible powertrain strategies. General Motors recently modified its EV targets, while Toyota has consistently advocated for a diversified approach including hybrids and even hydrogen fuel cells.

This industry-wide recalibration suggests that the transition to electric transportation will unfold more gradually than many experts predicted. The path forward likely involves multiple technologies coexisting—pure EVs for urban users with charging access, hybrids for mainstream consumers, and advanced combustion engines for specific applications.

Environmental Considerations and Policy Impacts

Ford's shift raises questions about meeting emissions regulations and climate goals. However, hybrid technology offers a pragmatic pathway to reduced emissions while infrastructure and technology mature. A fleet of hybrids achieves more immediate environmental benefits than a smaller number of pure EVs, especially when accounting for the entire vehicle lifecycle including battery production.

Government policy will play a crucial role. Extended tax incentives for both EVs and hybrids, expanded charging infrastructure investment, and realistic regulatory timelines can support the transition without forcing manufacturers into unsustainable positions.

Looking Ahead: The Future of Ford and EVs

Ford's recalibration doesn't signal failure—it demonstrates adaptability. The automotive industry is navigating unprecedented transformation, and successful companies will be those that respond flexibly to market realities rather than rigidly adhering to predetermined plans.

Electric vehicles will eventually dominate, but "eventually" may take longer than anticipated. Ford's balanced approach positions the company to compete across multiple powertrain technologies while maintaining financial stability and consumer trust.

For consumers, this means more choices and less pressure. Whether you're drawn to EVs, prefer hybrids, or still want traditional engines, Ford and other manufacturers will continue serving diverse preferences. The future of transportation is coming—just at a more realistic pace.

Comments (0)

Please log in to comment

No comments yet. Be the first!