Finance & Business

China Hits 5% GDP Growth Target in 2025 Despite Trump Tariffs & Property Slump

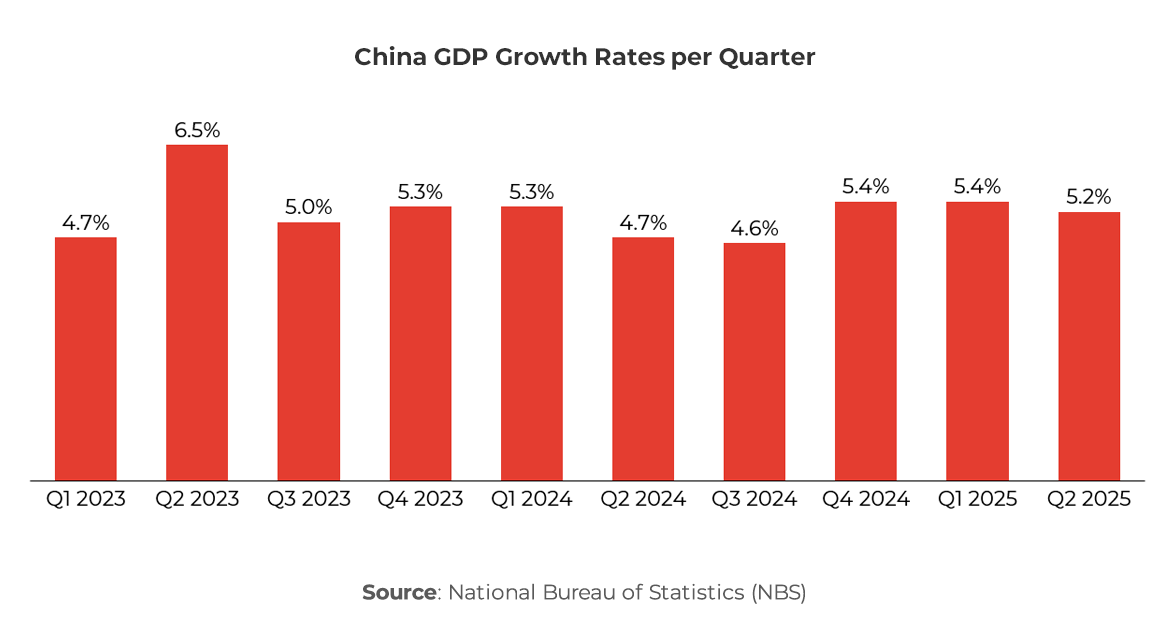

On January 19, 2026, China's National Bureau of Statistics released official 2025 economic data showing the world's second-largest economy grew 5% year-on-year, precisely hitting Beijing's official target for the year. Despite aggressive US tariffs under President Trump, a prolonged property market crash, and sluggish domestic consumption, strong exports and a record trade surplus powered the result—though momentum weakened sharply in Q4 to 4.5% growth, the slowest quarterly pace since late 2022.Full-year GDP reached RMB 140.19 trillion (~$19.6 trillion), up 5.0% at constant prices. The figure masks a "two-speed" economy: manufacturing and exports thrived while households remained cautious, investment lagged, and real estate dragged heavily. Analysts note the growth relied heavily on external demand, a strategy increasingly vulnerable amid global protectionism.Key Drivers & HeadwindsExports Defy Tariffs: China's trade surplus hit a record $1.19–1.2 trillion in 2025. While US-bound shipments fell sharply (down ~20%), exports surged to Europe, Asia, and emerging markets—diversifying away from America. High-tech and manufacturing held strong.

Property Crisis Lingers: New home sales at 15-year lows, prices plummeting—eroding household wealth and confidence. Real estate woes continued to weigh on consumption and investment.

Domestic Weakness: Retail sales and services grew modestly; consumer caution persisted amid deflation risks and job concerns.

Q4 Slowdown: Growth eased to 4.5% YoY (from 4.8% in Q3), reflecting fading stimulus effects and external pressures.

Beijing's policymakers targeted "around 5%" for 2025, achieved through industrial strength and trade resilience. However, experts like those at Moody's and Reuters warn of unsustainability—growth became "lopsided," propped by exports while domestic demand remains fragile.2026 Outlook & Global ImpactForecasts suggest China may target ~5% again, but Reuters polls predict 4.5% growth amid ongoing trade tensions and property stabilization needs. Trump tariffs (expanded in 2025) could intensify challenges, though diversification helped blunt the blow last year.At digital8hub.com, we track global economy trends 2026, trade policy, China business news, investment insights, and tech intersections (AI supply chains, gadgets). For guides on China market exposure, tariff hedging, or productivity in uncertain times, explore our finance and business resources.China's 5% hit shows resilience—but the real test ahead is reviving domestic demand without relying solely on exports. Watch Beijing's stimulus moves closely.

Comments (0)

Please log in to comment

No comments yet. Be the first!